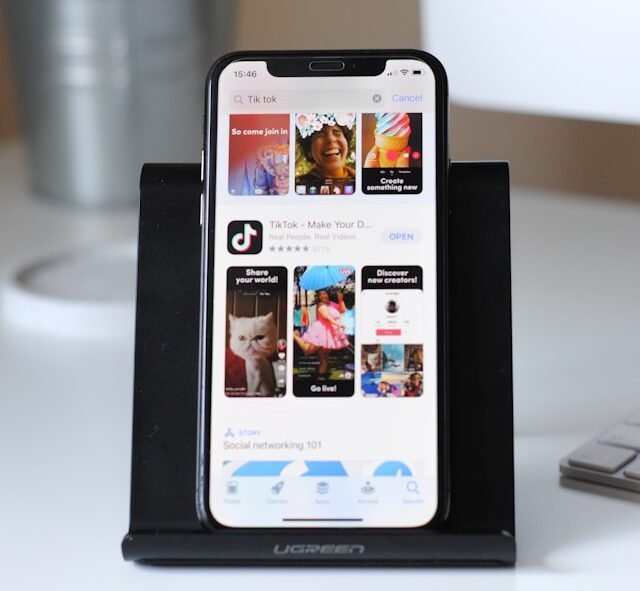

Is your family struggling to stay present due to excessive screen time? Do you catch yourself endlessly scrolling while your child is glued to their tablet? The digital age has made connection easier—but often at the cost of real, in-person moments. It’s time to take a step back and embrace a digital detox family lifestyle…

FIRE Movement Reimagined: Financial Independence, Live on Your Own Terms

Ever felt the tug of the traditional FIRE movement, the dream of early retirement, yet balked at the idea of years of extreme frugality? You’re not alone. But there you are, dreaming of freedom, yet feeling trapped by the “rules.” Why? Because the FIRE movement reimagined offers a better path. It’s about financial independence, live…

Why Everyone is Obsessed with Cottagecore Slow Living (And How to Start!)

Finding Peace in a Fast-Paced World Picture this: The morning sun spills golden light through lace curtains as you sip herbal tea in a cozy nook. A loaf of fresh bread cools on the counter, the scent of lavender wafts through an open window, and outside, birdsong greets the day. Sounds idyllic, doesn’t it? Yet,…

The Dark Side of Work-Life Integration: Why Balance Is a Myth

Is Work-Life Balance Outdated? The Reality of Work-Life Integration You’ve read the advice a thousand times: “Set clear boundaries between work and life.” “Unplug after office hours.” “Find a work-life balance.” But what if I told you that work-life balance, as we know it, is a myth? We live in a world where work bleeds…

Budgeting for a Simpler Life: A Practical Guide to Financial Freedom

Is Your Budget Helping You Live the Life You Want? Imagine waking up every morning with complete financial peace of mind. No stress about unexpected expenses. No worrying if you have enough to make it to the end of the month. Just a simple, intentional life where your money aligns perfectly with your values. Sounds…

Why Work-Life Balance is Outdated (And What to Do Instead)

Is Work-Life Balance a Lie? We’ve all heard it—work-life balance is the key to happiness. Endless articles and experts preach the magic formula: schedule your hours, set boundaries, and you’ll achieve harmony. But let’s be honest. Have you ever felt like you truly have it all balanced? Or do you constantly feel like you’re failing…

Practicing Intentional Spending: Needs vs. Wants

Have you ever wondered where your money disappears by the end of the month? You start with a budget, yet somehow, unexpected expenses creep in, and suddenly, your savings goal seems out of reach. This is where practicing intentional spending comes in. By distinguishing between needs vs. wants, you can regain control of your finances,…

The Psychology of Slow Living: How a Slower Pace Can Boost Mental Health

Ever feel like life’s moving too fast? You’ve got a million things to do, but every time you check your to-do list, it feels longer than before. Sound familiar? What if slowing down was the answer to feeling more in control, more at peace, and actually achieving what matters most? The psychology of slow living…

Ditch the Digital Frenzy: How to Overcome FOMO and Embrace JOMO

Are You Trapped in the Fear of Missing Out? Ever found yourself doom-scrolling through social media, watching others live seemingly perfect lives, while you sit there feeling like you’re missing out? That creeping anxiety, that fear of missing out (FOMO), is all too familiar in the digital age. But what if missing out was actually…

The Courage to Say No: Mastering Boundaries for a Simpler, Stress-Free Life

Why Saying No is a Superpower for Simple Living Do you remember the last time you said “yes” to something you didn’t want to do? Maybe it was attending a gathering that drained you, taking on extra work when you were already overwhelmed, or loaning money to someone despite knowing it would strain your finances….